Being self-employed comes with a lot of perks, but it also means you’re responsible for handling your finances. One essential tool for managing your business finances is a profit and loss statement. This document tells you how much revenue you generated, how much money you spent, and what you netted or lost during a given period.

In this article, we’ll explore what a profit and loss statement for self-employed individuals is, why it’s important, and how to create one. We’ll also provide examples, sample templates, and tips for successful financial management.

What is a profit and loss statement for self-employed?

A profit and loss statement for self-employed individuals is a financial document that summarizes your business’s revenues, expenses, and net profit or loss during a specific period. It provides a clear snapshot of your business’s financial health and helps you make informed decisions about your operations. This statement is often used by self-employed individuals when filing taxes, applying for loans, or seeking investors.

The profit and loss statement, also known as an income statement or statement of earnings, is typically divided into several categories, including revenue, cost of goods sold, operating expenses, and taxes. It calculates the net profit or loss by subtracting the total expenses from the total revenue. The resulting figure is a crucial indicator of your business’s financial performance.

Why is a profit and loss statement important for self-employed individuals?

A profit and loss statement is vital for self-employed individuals for several reasons:

- Financial analysis: It provides a comprehensive overview of your business’s financial performance and helps you identify trends, areas of improvement, and potential issues.

- Tax reporting: It simplifies the process of filing taxes by outlining your business’s income and deductible expenses.

- Budgeting and forecasting: It assists in creating realistic budgets and forecasts based on historical financial data.

- Borrowing and investment: It serves as proof of income when applying for loans or seeking investors.

- Decision-making: It helps you make informed decisions about pricing, cost control, and business expansion.

How to create a profit and loss statement for self-employed

Creating a profit and loss statement for self-employed individuals requires a systematic approach. Here’s a step-by-step guide to help you:

Step 1: Gather your financial records

Before you can create a profit and loss statement, you need to gather all your financial records for the specific period you want to analyze. This includes sales invoices, expense receipts, bank statements, and any other relevant documents.

Step 2: Categorize your revenues and expenses

Next, categorize your revenues and expenses into appropriate categories. Common revenue categories include sales, service fees, and rental income. Expense categories may include rent, utilities, salaries, and office supplies.

Step 3: Calculate your revenue

Add up all your revenues for the specified period. This includes both cash and credit sales. If you have multiple revenue streams, calculate each one separately.

Step 4: Calculate your cost of goods sold (COGS)

If you sell physical products, you’ll need to calculate your cost of goods sold. This includes the cost of materials, manufacturing, and direct labor. Subtract your COGS from your revenue to determine your gross profit.

Step 5: Calculate your operating expenses

List all your operating expenses, such as rent, utilities, marketing, and insurance. Add up these expenses to determine your total operating expenses.

Step 6: Calculate your net profit or loss

Subtract your total operating expenses from your gross profit to calculate your net profit or loss. If your total expenses exceed your gross profit, you have a net loss.

Step 7: Prepare the profit and loss statement

Organize the information you’ve gathered and calculate it into a profit and loss statement format. You can use accounting software, spreadsheets, or online templates to create a professional-looking statement.

Examples

Tips for successful financial management

Managing your finances as a self-employed individual can be challenging, but with the right strategies, you can ensure financial success. Here are some tips to help you:

- Keep accurate records: Maintain detailed records of all your financial transactions, including income and expenses. This will make it easier to create accurate profit and loss statements and track your business’s financial performance.

- Separate personal and business finances: Open a separate bank account for your business and avoid mixing personal and business expenses. This will make it easier to track your business’s financial health and simplify tax reporting.

- Create a budget: Develop a budget that aligns with your business goals and stick to it. Regularly review and adjust your budget based on your financial performance.

- Monitor your cash flow: Keep a close eye on your cash flow to ensure you have enough funds to cover your expenses. Consider implementing invoicing and payment systems that help you get paid promptly.

- Seek professional advice: If you’re unsure about managing your finances, consider hiring a professional accountant or bookkeeper to assist you. They can provide valuable insights and ensure your financial records are accurate and compliant with tax regulations.

Conclusion

A profit and loss statement is an essential tool for self-employed individuals to track their business’s financial performance. By creating and analyzing this statement regularly, you can make informed decisions, improve your financial management, and ensure the success of your business.

Remember to keep accurate records, separate personal and business finances, and seek professional advice when needed. With these strategies in place, you’ll be well on your way to financial success.

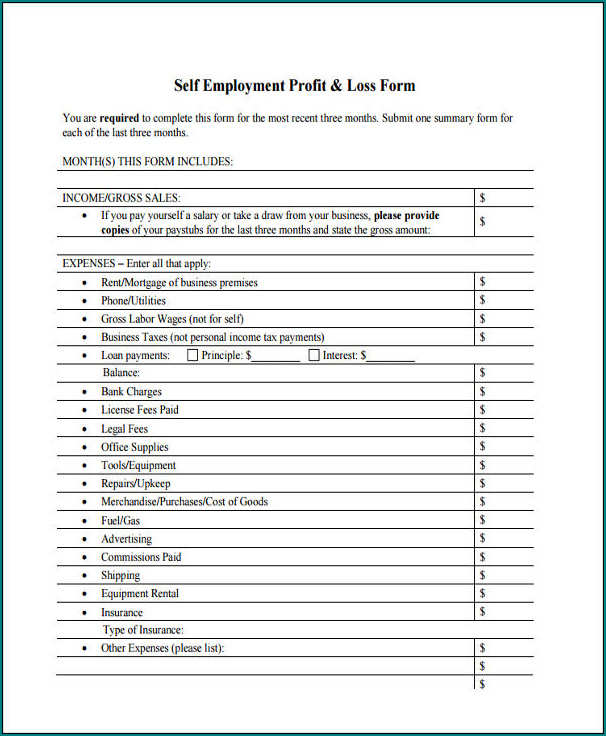

Profit And Loss Statement Template For Self Employed – Download

I am Huguette Prudence, the writer and curator of this website. With a profound passion for writing and reading, I strive to create insightful and engaging content. My background includes managing a small online shop and overseeing a business website, experiences that have honed my skills and broadened my understanding of effective online communication. Thank you for visiting Huguetemplate.net, where I aim to share knowledge and inspiration through carefully crafted content.