As a business owner, having a streamlined system in place for managing payments is crucial. One essential component of this system is a payment receipt. This receipt serves as proof of purchase and helps the business owner and the customer keep track of transactions.

This article will explore the importance of payment receipts for business owners and provide valuable insights on creating and utilizing them effectively.

What is a Payment Receipt?

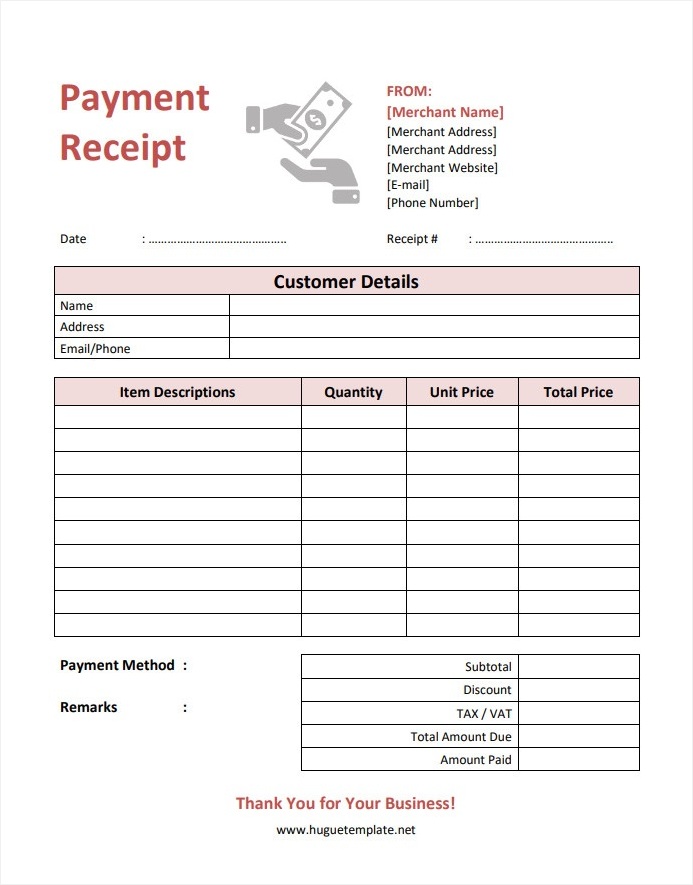

A payment receipt is a document that acknowledges the payment made by a customer to a business. It typically includes information such as the date of the transaction, the amount paid, the method of payment, and the details of the product or service purchased.

This receipt is usually given to the customer at the time of payment and can also be sent via email or printed for record-keeping purposes.

Why Should Business Owners Use a Receipt?

There are several compelling reasons why business owners should use payment receipts:

- Record-keeping: payment receipts ensure that all transactions are properly documented, making it easier for business owners to track revenue and expenses.

- Customer trust: Providing a receipt to customers instills confidence and trust in your business. It shows that you are committed to transparency and professionalism.

- Tax compliance: payment receipts can be used as supporting documents for tax purposes, helping business owners accurately report income and expenses.

- Dispute resolution: In case of any discrepancies or disputes, a payment receipt can serve as evidence of the transaction and help resolve issues amicably.

- Efficiency: By using payment receipts, business owners can streamline their financial processes and reduce the chance of errors or omissions.

How to Write a Receipt for Payment

Here are the steps to follow:

- Download a template: Download our free customizable payment receipt template in Word format available on this website.

- Add your business details: Include your business name, logo, address, and contact information at the top of the receipt. This helps in branding and makes it easier for customers to reach out if needed.

- Include transaction details: Clearly state the date of the transaction, the amount paid, the method of payment, and any additional relevant information such as invoice numbers or product details.

- Provide a receipt number: Assign a unique receipt number to each transaction. This helps in organizing and referencing receipts in the future.

- Add terms and conditions: If applicable, include any terms and conditions related to refunds, warranties, or returns. This provides clarity to customers and protects your business.

- Include a signature or stamp: Depending on your business’s requirements, you may choose to include a signature or stamp on the receipt. This adds an extra layer of authenticity.

- Save and print: Save the receipt as a digital file for future reference and print a copy for the customer. Alternatively, you can email the receipt to the customer if preferred.

When Should Business Owners Provide Payment Receipts?

As a general rule, business owners should provide payment receipts for every transaction, regardless of the payment method. This ensures consistency and transparency in your business practices. Whether the payment is made in cash, credit card, or through an online platform, a receipt should always be provided to the customer.

Business owners should also consider providing receipts for partial payments or deposits. This helps in keeping a record of the payment received and the outstanding balance, if any.

Additional Tips for Your Business Operations

While creating payment receipts is important, utilizing them effectively can further enhance your business operations. Here are some tips:

- Maintain a digital backup: Along with printing a physical copy, save a digital backup of each receipt. This ensures that you have a backup in case of loss or damage.

- Organize receipts systematically: Develop a filing system to organize and store receipts in an orderly manner. This makes it easier to retrieve receipts when needed and aids in bookkeeping.

- Automate receipt generation: Consider using accounting or point-of-sale software that generates receipts automatically. This saves time and reduces the chance of manual errors.

- Regularly reconcile receipts with financial records: Periodically cross-check your receipts with your financial records to ensure accuracy and identify any discrepancies that may require further investigation.

- Train your staff: If you have employees handling cash transactions, provide them with proper training on generating and issuing receipts. This ensures consistency and reduces the chance of errors.

Download the Payment Receipt Template!

Stay organized with our printable payment receipt template!

Customizable to include transaction details, payment methods, and customer information, this template simplifies your record-keeping process. With clear sections for receipts, invoices, and payment terms, maintain professionalism and accuracy in your financial transactions.

Download now to streamline your payment receipt procedures and ensure transparent record-keeping for your business or organization.

Payment Receipt Template – Word | PDF