A commercial credit application form is a document businesses use to apply for credit from a lender or supplier. It is a key tool for assessing a business’s creditworthiness before extending credit terms.

By providing important financial information and details about the company, this form helps lenders and suppliers make informed decisions about whether to grant credit and on what terms.

Why is a Commercial Credit Application Form Important?

For businesses, the ability to obtain credit from lenders or suppliers is crucial for maintaining cash flow and supporting growth. However, extending credit comes with risks, as there is always a chance that the borrower may default on payment. A commercial credit application form helps mitigate these risks by allowing lenders and suppliers to assess the creditworthiness of a business before extending credit terms.

By providing detailed information about the business’s financial situation, including its assets, liabilities, and credit history, lenders and suppliers can evaluate the business’s ability to repay the credit. This information also helps determine the appropriate credit limit and terms that would be suitable for the business.

How to Create a Commercial Credit Application Form?

Creating a commercial credit application form involves several important steps:

1. Determine the Required Information

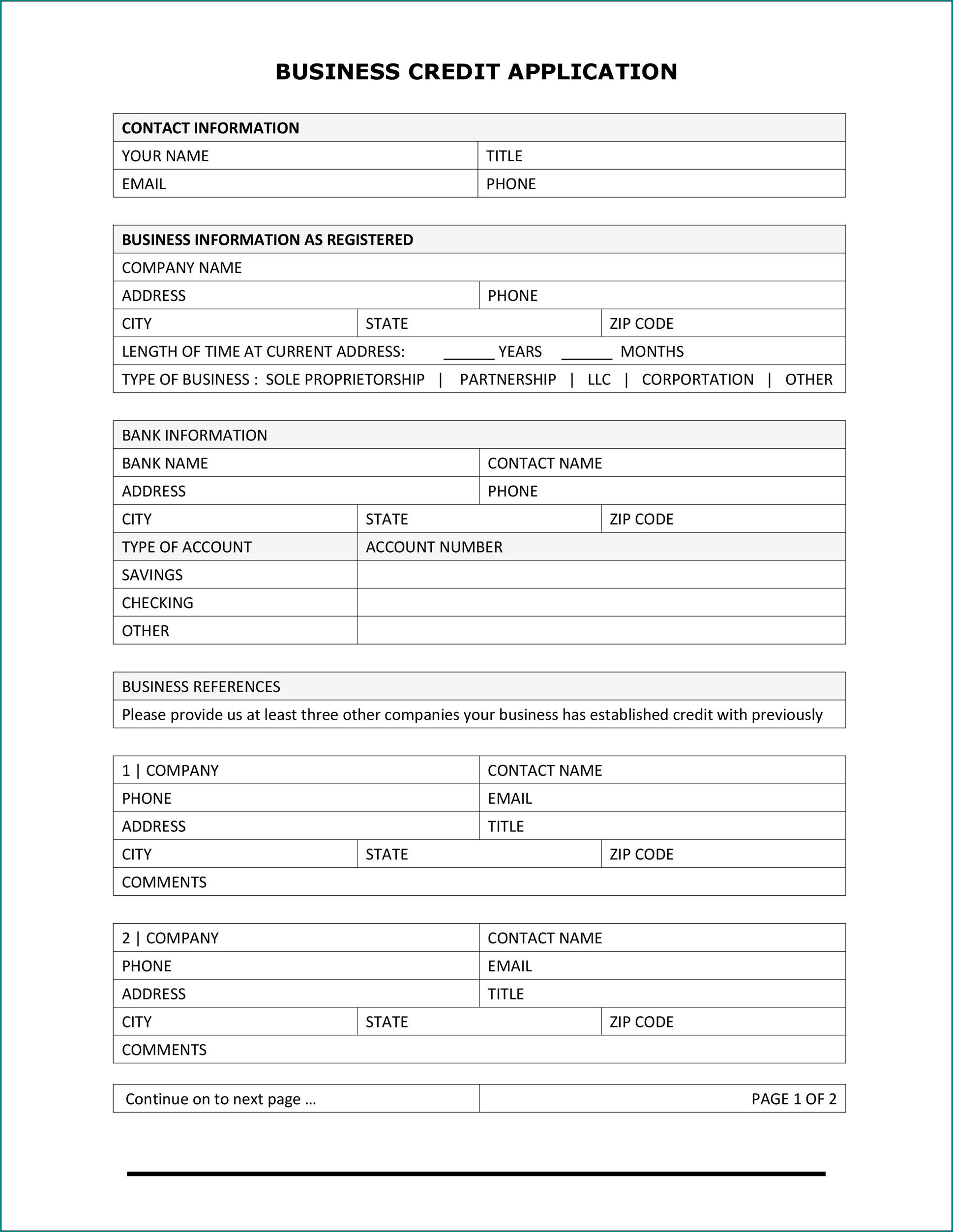

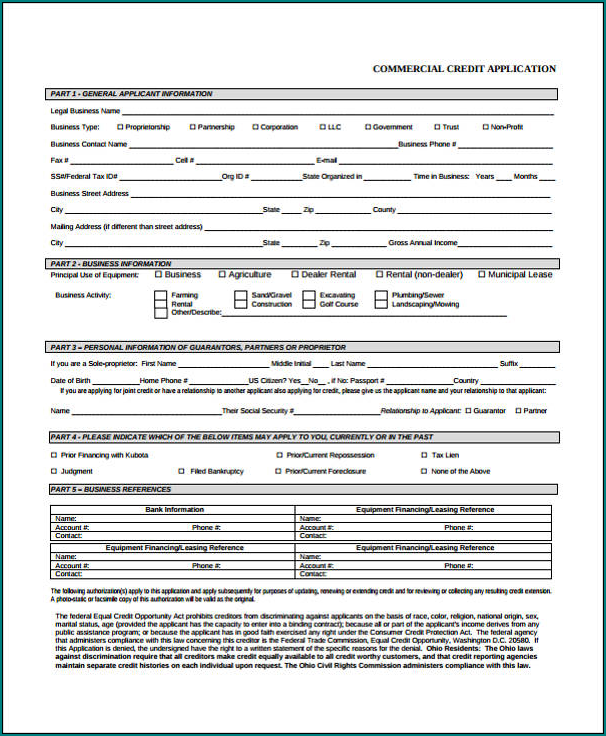

Identify the key information that lenders or suppliers would need to assess a business’s creditworthiness. This typically includes the business’s legal name, address, contact information, financial statements, bank references, trade references, and any other relevant financial information.

2. Design the Form

Design the form in a clear and organized manner, with sections for each required piece of information. Use headings and subheadings to make the form easy to navigate. Consider using a digital form that can be filled out electronically or a form that can be completed manually.

3. Include Terms and Conditions

Specify the terms and conditions that will apply to the credit being extended. This may include information about interest rates, payment terms, late payment penalties, and any other relevant terms. Make sure these terms are clearly stated and easy to understand.

4. Test and Review

Test the form to ensure it is user-friendly and captures all the necessary information. Review the form to check for any errors or omissions. Consider seeking input from legal or financial professionals to ensure compliance with applicable laws and regulations.

Examples

Tips for a Successful Commercial Credit Application Form

- Provide Clear Instructions: Clearly explain how to fill out the form and what information is required.

- Keep it Simple: Avoid unnecessary complexity and jargon. Use simple language and straightforward questions.

- Request Supporting Documentation: Ask for supporting documents, such as financial statements or tax returns, to verify the information provided.

- Include Contact Information: Provide a contact person and their contact details in case the lender or supplier has any questions or needs further information.

- Regularly Update the Form: Review and update the form periodically to ensure it captures the most relevant and up-to-date information.

- Consult Legal and Financial Professionals: Seek advice from professionals to ensure compliance with applicable laws and regulations and to optimize the effectiveness of the form.

The Benefits of Using a Commercial Credit Application Form

Using a commercial credit application form offers several benefits:

- Efficiency: By providing all the necessary information upfront, the form streamlines the credit application process and reduces the need for back-and-forth communication.

- Consistency: The form ensures that all applicants provide the same information, making it easier to compare and evaluate different businesses.

- Risk Mitigation: The form helps lenders and suppliers assess the creditworthiness of a business, minimizing the risk of extending credit to unreliable borrowers.

- Legal Protection: A well-designed and properly executed credit application form provides legal protection in case of payment disputes or defaults.

- Professionalism: Using a standardized form demonstrates professionalism and instills confidence in lenders and suppliers.

Conclusion

A commercial credit application form is an essential tool for businesses seeking credit from lenders or suppliers. By providing detailed financial information and other relevant details, this form helps lenders and suppliers assess a business’s creditworthiness and make informed decisions about extending credit terms.

By following the tips and best practices outlined in this article, businesses can create an effective and efficient credit application form that enhances their chances of obtaining credit and supports their growth and success.

Commercial Credit Application Form – Download

I am Huguette Prudence, the writer and curator of this website. With a profound passion for writing and reading, I strive to create insightful and engaging content. My background includes managing a small online shop and overseeing a business website, experiences that have honed my skills and broadened my understanding of effective online communication. Thank you for visiting Huguetemplate.net, where I aim to share knowledge and inspiration through carefully crafted content.