A monthly budget is a tool that helps you track your income and expenses, and plan how to spend your money. It provides a clear overview of your financial situation and allows you to make informed decisions about your spending.

By using a monthly budget, you can set financial goals, reduce debt, and build an emergency fund.

Why Should You Use a Monthly Budget?

Using a monthly budget has numerous benefits.

Here are some reasons why you should consider incorporating it into your financial routine:

1. Financial Goals: A budget helps you set and achieve your financial goals. Whether you want to save for a down payment on a house, pay off student loans, or go on a dream vacation, a budget provides a roadmap for reaching these milestones.

2. Debt Reduction: A budget allows you to allocate funds towards paying off debt. By tracking your expenses and identifying areas where you can cut back, you can free up money to put towards debt repayment, helping you become debt-free faster.

3. Emergency Fund: One of the key components of a healthy financial plan is having an emergency fund. A budget helps you prioritize saving and ensures that you are setting aside money for unexpected expenses, such as medical bills or car repairs.

How to Create a Monthly Budget

Creating a monthly budget may seem daunting, but with the right approach, it can be a straightforward and empowering process.

Follow these steps to create your budget:

1. Determine Your Income: Start by calculating your total monthly income. Include all sources of income, such as salaries, freelance work, or rental income.

2. Track Your Expenses: Next, track your expenses for a month. Keep a record of every dollar you spend, whether it’s on groceries, utilities, or entertainment. This will give you an accurate picture of where your money is going.

3. Categorize Your Expenses: Group your expenses into categories, such as housing, transportation, food, and entertainment. This will help you identify areas where you may be overspending and where you can make adjustments.

4. Set Financial Goals: Determine your short-term and long-term financial goals. Do you want to pay off credit card debt? Save for a down payment on a house? Write down your goals and assign a timeframe for achieving them.

5. Allocate Your Income: Based on your income and expenses, allocate your money to each category. Be realistic and prioritize your financial goals. Remember to set aside funds for savings and emergencies.

6. Monitor and Adjust: Regularly review your budget and track your progress. Make adjustments as needed to ensure that you are staying on track and reaching your financial goals.

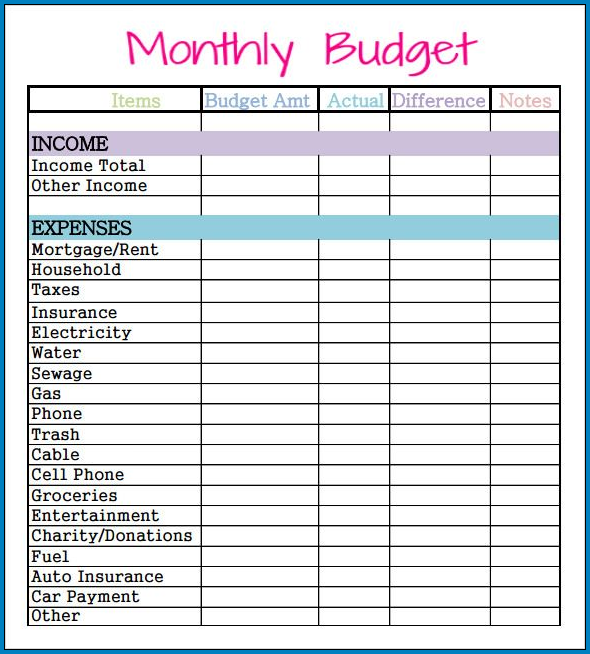

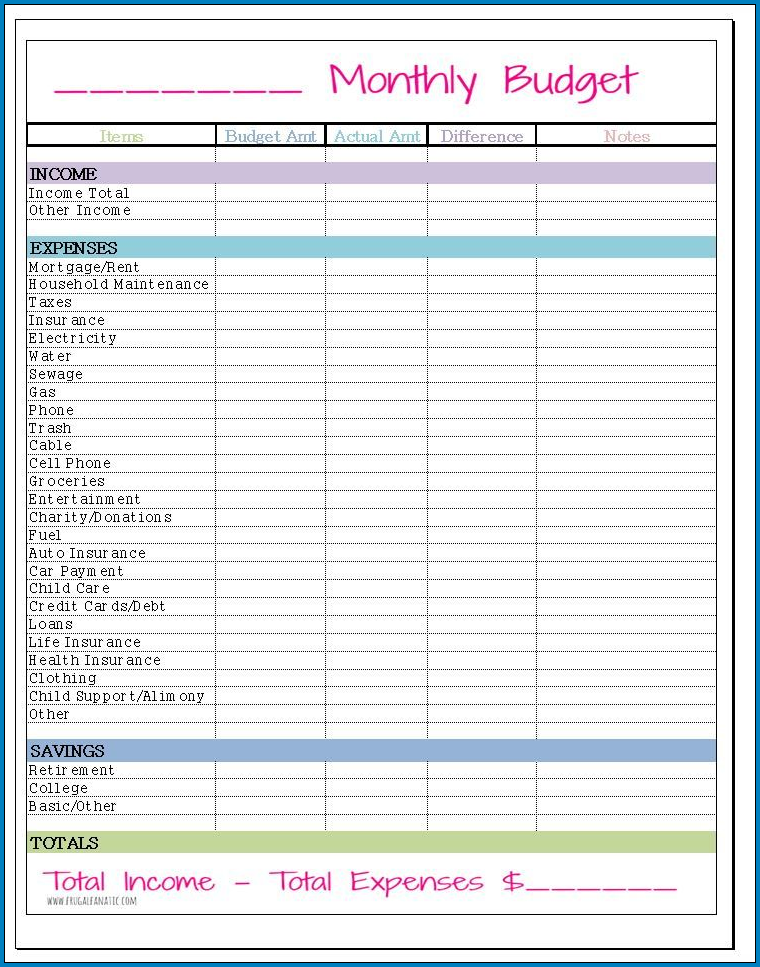

Example of a Monthly Budget

Here is an example of how a monthly budget may look:

Income:

– Salary: $3,000

– Freelance Work: $500

– Total Income: $3,500

Expenses:

– Housing: $1,200

– Transportation: $300

– Food: $400

– Utilities: $150

– Entertainment: $200

– Debt Repayment: $500

– Savings: $300

– Total Expenses: $3,050

In this example, the individual has allocated funds towards housing, transportation, food, utilities, entertainment, debt repayment, and savings. They have also prioritized their financial goals by setting aside money for debt repayment and savings.

Tips for Successful Budgeting

To make the most of your monthly budget, consider the following tips:

1. Track Your Expenses: Keep a detailed record of your expenses to ensure that you are accurately capturing your spending habits.

2. Be Realistic: Set realistic goals and allocate your income accordingly. Avoid overestimating your income or underestimating your expenses.

3. Review Regularly: Review your budget regularly to stay on track and make adjustments as necessary.

4. Plan for Unexpected Expenses: Include a category in your budget for unexpected expenses, such as car repairs or medical bills. This will prevent you from dipping into your savings or going into debt when emergencies arise.

5. Seek Professional Help: If budgeting feels overwhelming or you need assistance with debt management, consider seeking help from a financial advisor or credit counselor.

6. Stay Motivated: Keep your financial goals in mind and celebrate milestones along the way. Staying motivated will help you stick to your budget and achieve financial success.

Conclusion

A monthly budget is a powerful tool that can help you take control of your finances, achieve your financial goals, reduce debt, and build an emergency fund. By following the steps outlined in this article and incorporating budgeting into your financial routine, you can pave the way for a secure and prosperous future.

Start today and experience the peace of mind that comes with financial stability.

Monthly Budget Template – Download

I am Huguette Prudence, the writer and curator of this website. With a profound passion for writing and reading, I strive to create insightful and engaging content. My background includes managing a small online shop and overseeing a business website, experiences that have honed my skills and broadened my understanding of effective online communication. Thank you for visiting Huguetemplate.net, where I aim to share knowledge and inspiration through carefully crafted content.