Managing the financial aspects of a business can be a challenging task. As a business owner, it is crucial to understand your company’s financial health clearly.

The profit and loss statement is one of the most important financial reports that can help you gain insights into your business’s profitability.

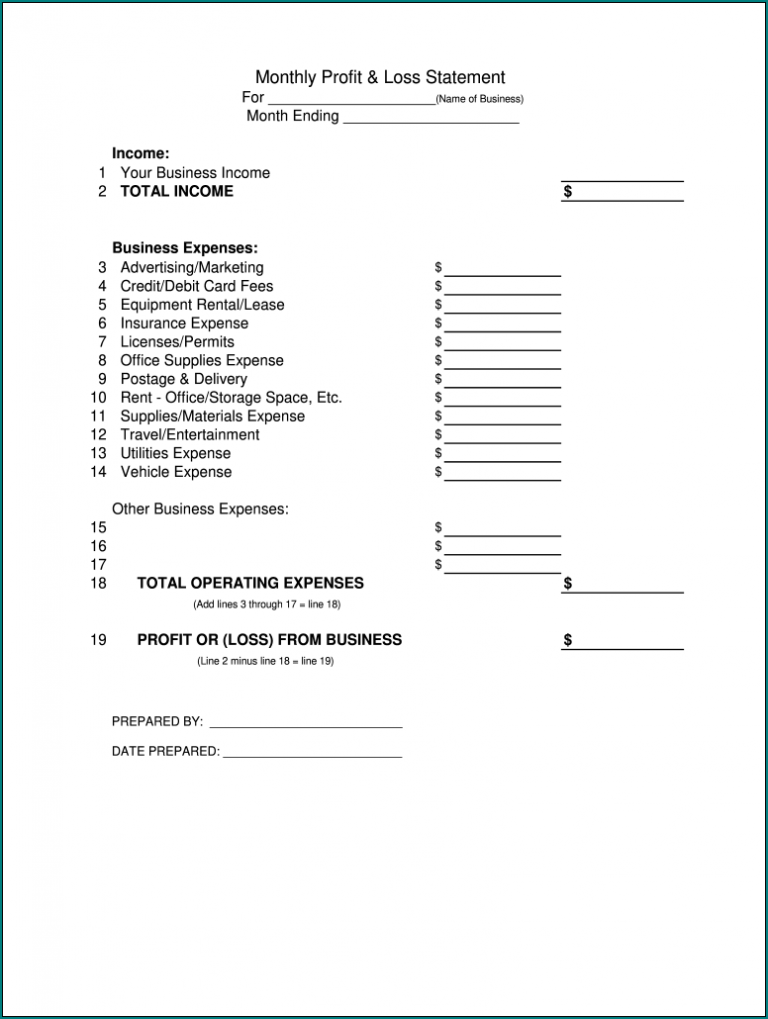

What is a Profit and Loss Statement?

A basic profit and loss statement, also known as a P&L statement or an income statement, is a financial report that provides a summary of your business’s revenues, costs, and expenses over a specific period. It shows how much your business has spent and earned during that time, allowing you to determine whether you have made a profit or incurred a loss.

The profit and loss statement is an essential tool for assessing the financial performance of your business. It helps you identify areas where you can reduce expenses, increase revenue, and make more informed decisions to improve profitability.

Why is a Basic Profit and Loss Statement Important?

A basic profit and loss statement is crucial for several reasons:

- Financial Analysis: It provides a detailed overview of your business’s financial performance, allowing you to analyze revenue and expenses and identify trends over time.

- Budgeting and Forecasting: By analyzing your profit and loss statement, you can create realistic budgets and make accurate financial forecasts for the future.

- Decision Making: The profit and loss statement helps you make informed decisions about pricing, cost control, and growth strategies based on your business’s financial performance.

- Tax Reporting: It serves as a valuable document for tax reporting purposes, helping you calculate your taxable income and fulfill your tax obligations accurately.

How to Create a Basic Profit and Loss Statement?

Creating a basic profit and loss statement involves several steps:

1. Gather Financial Data

Start by collecting all the necessary financial data, including sales records, expense receipts, and other relevant documents. Ensure that you have accurate and up-to-date information for the specified time.

2. Determine Revenue

Identify and calculate all sources of revenue for your business during the specified period. This includes sales revenue, service income, and any other sources of income.

3. Calculate the Cost of Goods Sold (COGS)

If your business involves selling products, calculate the cost of goods sold (COGS) by considering the direct costs associated with producing or purchasing the goods you sell. This may include materials, labor, and other production costs.

4. Calculate Operating Expenses

Identify and calculate all operating expenses, including rent, utilities, salaries, marketing expenses, and other costs incurred to run your business. Be sure to categorize these expenses accurately.

5. Calculate Gross Profit

Subtract the cost of goods sold (COGS) from your revenue to calculate the gross profit. This figure represents the amount of money you have made after accounting for the direct costs associated with producing your goods or services.

6. Calculate Net Profit

Subtract the operating expenses from the gross profit to determine the net profit. This figure indicates the final amount of money your business has earned after accounting for all costs and expenses.

7. Review and Analyze the Statement

Review the profit and loss statement for accuracy and completeness. Analyze the figures to gain insights into your business’s financial performance, identify areas for improvement, and make informed decisions.

Examples

Tips for Successful Profit and Loss Statement Analysis

Here are some tips to help you effectively analyze your profit and loss statement:

- Compare Periods: Compare your current profit and loss statement with previous periods to identify trends and changes in your business’s financial performance.

- Monitor Key Performance Indicators (KPIs): Identify and track key performance indicators, such as gross profit margin, net profit margin, and operating expense ratio, to assess your business’s financial health.

- Seek Professional Help: If you are unfamiliar with financial statements or need assistance in analyzing them, consider consulting with a professional accountant or financial advisor.

- Use Accounting Software: Consider using accounting software to automate the process of creating and analyzing profit and loss statements. This can save time and ensure accuracy.

In Conclusion

A basic profit and loss statement is a valuable financial report that provides insights into your business’s financial performance. By creating and analyzing this statement, you can make informed decisions, improve profitability, and ensure the long-term success of your business.

Basic Profit And Loss Statement Template – Download

I am Huguette Prudence, the writer and curator of this website. With a profound passion for writing and reading, I strive to create insightful and engaging content. My background includes managing a small online shop and overseeing a business website, experiences that have honed my skills and broadened my understanding of effective online communication. Thank you for visiting Huguetemplate.net, where I aim to share knowledge and inspiration through carefully crafted content.